Investment Banking Information Sessions: A Way to Stand Out as a Human in a Virtual World, or a Complete Waste of Time?

Some people like to complain about networking in general, but if there’s a specific part of networking that almost everyone likes to complain about, it’s investment banking information sessions.

In these sessions, employers such as large banks visit university and business school campuses to present their firms and let students speak with bankers.

There’s a wide variety of information sessions, ranging from in-person to virtual, and a session could be for the entire school, one club or group, or just one student segment (diversity recruiting).

In theory, investment banking information sessions are a great way to meet bankers, make your case, and gain an advantage in the recruiting process.

In reality, they’re often difficult to use, the timing can be tricky, and most students waste time at these events.

Also, as the entire recruiting process has become more impersonal and automated (HireVue, online tests, etc.), in-person events, if they even exist, probably help less than they did in 2005 or 2015.

But let’s start by explaining the different types of sessions first:

Types of Information Sessions: Undergrad, MBA, Specialized, and Virtual

Here are the main categories:

- Undergraduate, Entire School – These sessions might have dozens or hundreds of students attending. Since they’re open to everyone at the school, it can be quite difficult to get bankers’ attention. Making a few connections and following up afterward are the most important points.

- MBA Level – These sessions are often formal parts of the recruiting process, and you may not even be allowed to request business cards or contact information. These sessions are more like slightly relaxed, fit-focused in-person interviews.

- Specialized – These include sessions for people in specific clubs, from specific countries or backgrounds, or with specific skills (e.g., languages). Since these sessions are much smaller and are open only to certain people, they’re also more valuable.

- Virtual – Finally, with interviews and applications going virtual and a seemingly never-ending pandemic and ongoing social weirdness, banks now host information sessions online as well.

When Are Investment Banking Information Sessions Useful vs. Useless?

Virtual information sessions are easily the most useless type because you can’t make a human connection with bankers, there are still too many students, and it’s impossible to get individual contact information.

In other words, they combine the worst parts of online networking and in-person networking.

Information sessions tend to be most useful when:

- They Are Highly Specific/Exclusive – The classic example is a session for diversity recruiting, but there are others, such as an event for just one club on campus.

- They Have a Low Student-to-Banker Ratio – It’s best if there are only a few students per banker; if the ratio is something like 20+, don’t even bother. Think: every single information session in London.

- You Have an Unusual Background or Go to a Non-Target School – You might not come across well via LinkedIn, email, or even the phone, but you can present yourself effectively in-person.

- Your EQ Exceeds Your IQ – It might be tough to break through electronically if your on-paper stats aren’t so great, but if you’re very personable, in-person networking could get you great results.

All that said, I don’t think it’s a complete waste to attend overly crowded information sessions.

Occasionally, banks note the attendees and use the lists to filter out applicants.

If you’re at a target school with many of these sessions, you can show up, sign in, and assess the student-to-banker ratio as people arrive.

If it’s terrible, don’t spend more than 30 minutes there – leave and go back to 1-on-1 networking via emails and LinkedIn.

Can You Attend a Session If You’re Not a Student at the School?

Before moving on, we have to address one of the most common questions asked by students at non-target schools: can you attend a school’s session if you’re not a student there?

There’s no universal rule, but my answer is: “It’s worth a shot if you don’t have to spend much time and money to get there.”

There’s a good chance you’ll get rejected at the door if you don’t have a student ID, and even if you get inside, some bankers may not react well (others may appreciate your initiative).

So, if you can attend a session at another school by taking a short trip there (~1 hour), go ahead.

But I wouldn’t recommend spending multiple hours on the trip or traveling internationally to attend because your chances of getting rejected are too high to justify the time and money spent.

How to Find and Prepare for IB Information Sessions

There isn’t much to say about finding these sessions: check your school’s recruiting site and ask finance/economics/consulting-related clubs at your school.

Unfortunately, it’s not possible to “research” the bankers at each session because banks don’t publish the lists in advance, and even if they did, they frequently change at the last minute.

So, all you can do is general preparation, such as:

- Dress Code – If in doubt, you can never go wrong with business formal. If you’re attending multiple sessions in a short time frame, you need to make sure your clothes are clean and ready to use for each one.

- Logistics – It helps if you can bring a friend, so you’re more confident and have a “Plan B” if the session is too crowded; arriving early also helps because it may be less crowded.

- Your Question List – Be prepared with the standard set of questions about how the banker got into the industry, their impressions of your school, what they did in university, what they did in a previous career(s), etc.

- Your “Excuse to Leave” List – To get out of conversations, especially ones that are going nowhere, you should prepare a few common excuses to leave (you need to say hi to a friend, take a call, greet someone else you know, etc.).

High-Level Walkthrough of an Information Session

Trying to ask “smart” questions in the opening portion with the presentation usually backfires, so stay focused on the meet-and-greet afterward.

Once that part begins, avoid eating or drinking more than the bare minimum.

You can keep something in your hand, but you’re there to network, not to get free food – and if you drink alcohol, getting even a bit tipsy can hurt your chances.

When you approach people, it’s best to open by referencing something mentioned in the Q&A panel or something about the campus experience.

If those do not work, going up and saying, “Hi, I’m [Name], nice to meet you” also works. Thank them for their time and go from there.

In most cases, bankers will be surrounded by other students, so you’ll have to listen to these conversations and find a good moment to jump in.

One method is to say something more lighthearted, such as a joke about the presentation or other students’ questions – but you need to be fairly confident in group settings to do this.

If you can’t think of anything like that, wait for a lull and ask a follow-up question that extends logically from whatever the last person said.

Your general goal is to limit each group conversation to 15-20 minutes (5-10 minutes if you’re somehow in a 1-on-1 conversation) and find common ground (travel, sports, entertainment, hobbies, etc.) quickly.

Draw from your question list and ask the usual ones about their career, bank, and experiences so far, and as you near the time limit, use one of your excuses to exit the chat and get their business card.

Before moving on to the next person, take notes on everything you discussed. You could do this on your phone, or you could do it the old-school way and jot down the key points on the back of their card.

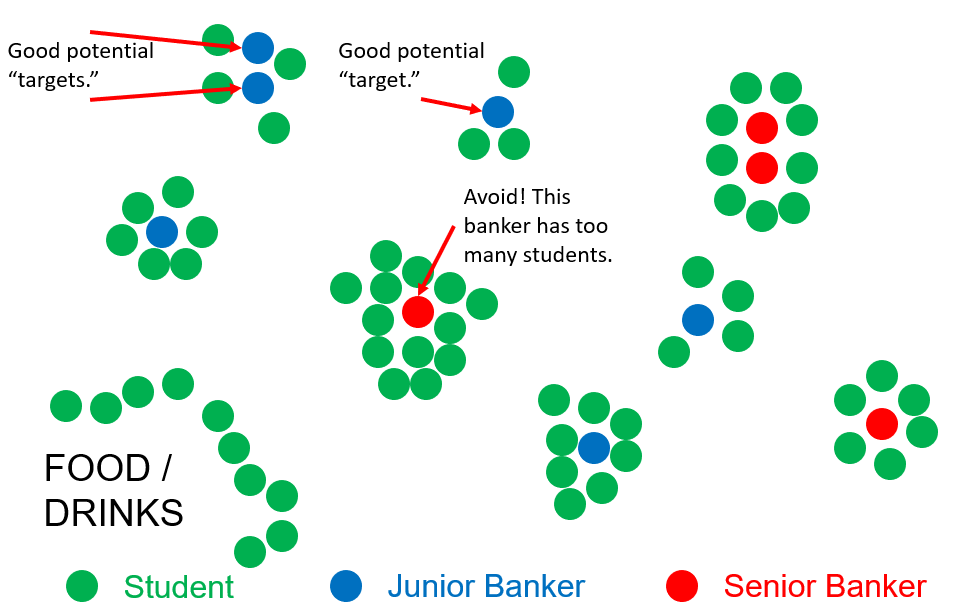

Situational awareness is required to decide who to approach and who to avoid.

For example, here’s a “chart” of an information session with 10 bankers and ~60 students:

Each time you finish speaking with someone, you should scout the room and look for other people that are somewhat less crowded.

If no bankers seem approachable, that’s OK – you can always attempt to join a few group chats, but if it’s impossible to get in a word, cut your losses and leave early.

If you spend 2 hours at an information session that’s crowded but not insanely crowded, a good target might be to get contact information for at least 5 bankers.

That might not seem like much for 2+ hours of work, but these 5 connections are “worth more” than alumni and bankers found online because you’ve met them all in real life.

MBA-Level Differences

The main difference here is that these sessions are more of a formal step in the recruiting process, so you can’t necessarily get cards and follow up afterward.

Most of the principles above still apply – find less-crowded bankers, find graceful ways to enter and exit conversations, etc. – but tracking your interactions and keeping your story consistent are even more important here.

There are fewer MBA-level candidates and positions, and banks track and cross-reference what you tell different people at their firm – so inconsistencies could lead to rejections.

What to Do After the Session

Assuming that you went to an undergrad-level session in which students were allowed to get contact information from bankers, following up quickly is the most important next step because:

- Bankers there probably met a lot of students, and if you don’t email them quickly, they’ll forget who you are.

- Information sessions usually take place close to the application open date, so you can’t afford to wait long.

If you got contact information for 5-10 bankers, follow up with everyone within 24 hours and space it out, so you contact a few bankers immediately after the session and the rest the next day.

In these follow-up emails, you should request a brief informational interview in which you go into more depth in one specific area, such as a challenge you’ve encountered in interviews.

There’s no point asking the banker general questions about their background because you should have already done that when you first met them in-person.

A follow-up email template might look like this:

SUBJECT: [University Name] Student – [Bank Name] Information Session

“[Name],

It was good meeting you at the [Bank Name] information session at [University Name] last night – as a reminder, I’m the student who [Briefly describe what you spoke about, what you had in common, why you had to leave early, etc.]. Thanks again for taking the time to speak with me about [your career at Bank Name / your experience in the Group Name group, etc.].

With internship recruiting starting in a few weeks, I wanted to ask if you had any additional advice about [an issue or potential challenge in your recruiting efforts].

I know you’re extremely busy, but if you have a few minutes next week, I am free on [Give specific days and times], and I would truly appreciate your input.

Thanks in advance,

[Your Name]”

Because you’ve already met the person, you can be more direct in this follow-up email by proposing specific days and times to speak.

These follow-up calls are similar to standard informational interviews, but the content of each call will vary based on your first interaction with the banker.

If you had a positive chat with the banker, you could ask for advice about specific recruiting issues that have come up so far (major/GPA concerns, age, work experience, finance knowledge, etc.).

If you had more of a neutral-to-negative chat, you have a non-standard profile, or you weren’t a student at the school, expect to be tested.

It could be anything from technical questions to a “bad cop” mini-interview where they ask about your weaknesses (perceived and actual).

Think of it as practice for real interviews and, if you can answer these questions effectively, another chance to ask for advice, referrals, and resume/CV endorsements.

Investment Banking Information Sessions: Final Thoughts

Many people claim that information sessions are useless due to the crowds.

Others admit that they don’t help much but say you still need to attend.

And others say they are actually important due to the in-person connections you can make.

There’s some truth to all these views, but the biggest problem is that students often waste time on useless sessions – so cut your losses early if you find yourself at one.

If you have to attend them as part of the MBA recruiting process or because certain banks want everyone to join their virtual sessions, sure, fine, do it.

But in most other cases, I wouldn’t recommend spending a lot of time on them.

Information sessions tend to be most useful in specialized cases, such as last-minute recruiting, non-standard candidacies, and people with certain ethnic/language/skill profiles that can get them into smaller events.

And even if you’re in one of these categories, what happens after the session is more important than whatever you do or say at the session.

If you’re not in one of these categories, your time is usually better spent conducting informational interviews and even cold emailing small firms to ask for internships.

But if you’re bored and already have an offer lined up, you can always attend an information session or two and wait for people to start asking stupid questions – and then you can go online to complain about it.

Read More

If you liked this article, you might be interested in:

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

Hey Brian,

On cycle PE started – got an offer and signed the first night – latest fund is ~$10bn. You’re guides were instrumental. Was super exited.

However, my base is $130, with $150k target bonus, so $280k all in. I’m seeing many other kids getting $350k all in, and if I stayed in banking, my base would be $175k, with a $150k bonus.

I know I’m in a great spot/very fortunate- but am I getting shafted on pay? I’m mainly interested in comp (wouldn’t have been happy staying in IB), so not sure if I made the right decision signing.

What are your thoughts?

If you’re actually serious (hard to tell online), I think you would be crazy to turn down a good on-cycle offer because you would earn slightly more in IB or at another PE firm. You’re taking a huge chance because you may not get another offer from the firms that are still recruiting, which means you then have to stay in IB for another year… and then when you interview again, you may or may not get another offer as good as this one.

Thanks – yeah I accepted the offer on the spot. It was a more reflective question of whether I made the right choice. I think I did. It just isn’t the best knowing I’ll be getting paid $70k less a year than my peers in IB/Smaller funds. Think my fund is just cheap. Oh well!