TMT Investment Banking: Technology, Media and Telecom Industry Group Overview

If there’s one thing that everyone has learned – or had reinforced – since early 2020, it’s that propaganda works.

It doesn’t matter whether a claim is true, false, or somewhere in between; if enough governments and media outlets repeat it over and over, people will assume it’s true.

And if you want a front-row seat for the entire process, TMT investment banking (“technology, media & telecom”) is the place to be.

We’ve covered technology investment banking in a separate article, so this one will focus on media & telecom investment banking.

It’s one of the best groups if you want to advise recognizable companies and gain access to a broad set of exit opportunities.

And if you envision a future career in propaganda, marketing, infomercials, or self-help books, all the better:

- TMT Investment Banking: Media & Telecom Focus

- Recruiting into TMT Investment Banking

- What Do You Do as an Analyst or Associate in TMT Investment Banking?

- Media & Telecom Trends and Drivers

- TMT Overview by Vertical

- TMT Accounting, Valuation, and Financial Modeling

- Example Valuations, Pitch Books, Fairness Opinions, and Investor Presentations

- TMT Investment Banking League Tables: The Top Firms

- TMT Investment Banking Exit Opportunities

- For Further Reading

- Pros and Cons of TMT Investment Banking

TMT Investment Banking: Media & Telecom Focus

TMT Investment Banking Definition: In TMT investment banking, professionals advise technology, media, and telecom companies on raising debt and equity and completing mergers, acquisitions, and asset sales.

The two broad categories outside of tech are telecom and media/entertainment.

Banks group these industries because they’re all related:

- Media/Entertainment: These companies produce content and earn money via advertising, subscriptions, or one-time sales.

- Telecom: These companies deliver the content via wireless and wireline (e.g., voice and fiber optics) services.

- Technology: These firms provide the software, hardware, and services to consume the content following its delivery.

Increasingly, TMT companies operate across multiple categories.

For example, AT&T started as a telecom company, but then it acquired Time Warner to enter the media business.

But then it changed its mind and decided to spin off WarnerMedia and merge it with Discovery.

Netflix started as a technology company but has increasingly become a media/entertainment company as it has produced original content.

With both telecom and media, subscribers, penetration rates, and average revenue per user (ARPU) are important metrics that companies highlight (at least when they’re good):

The difference is that telecom is viewed as more of a “defensive” sector:

- Demand for telecom services is relatively inelastic (even if you lost your job, would you give up your smartphone data plan?).

- The business is capital intensive because it’s expensive to build fiber-optic networks, cell towers, and satellites.

- And companies tend to be heavily regulated because governments view telecom services as a “public good.”

Worldwide, there’s at least one big telecom company in every large country because these firms typically cannot operate across national borders.

The media/entertainment side is more skewed to the U.S., but there are large European, Japanese, and Chinese companies as well.

Recruiting into TMT Investment Banking

Just as technology is not specialized in terms of accounting, valuation, or financial modeling, neither are media and telecom companies.

It helps to have a relevant background, such as electrical engineering or TV/film production, but it doesn’t give you the same boost that it would in a highly specialized group such as energy.

Banks follow the same recruitment process that they do for any other group: your university or business school, grades, work experience, networking efforts, and interview preparation make the biggest difference.

One difference compared with technology is that there are fewer boutique banks dedicated to media or telecom companies.

So, if you want to break into the industry via cold emails or cold calls, you should probably look for TMT or tech-focused banks, even if you’re more interested in the other sectors.

What Do You Do as an Analyst or Associate in TMT Investment Banking?

Your workflow depends heavily on the type of bank you’re at and the companies you advise.

If you’re advising massive corporations like AT&T, Verizon, Comcast, and T-Mobile, expect to work on many debt issuances and the occasional buy-side M&A deal.

“Large” M&A deals are not common in the telecom sector because of regulations and the difficulty in completing cross-border deals; I found only ~40 deals worth over $500 million worldwide over the past decade.

If you want to see how skewed the debt vs. equity landscape is, take a look at ~15 of AT&T’s recent public offerings:

Investors believe that large telecom companies have “stable cash flows,” so they make for ideal debt issuers.

There are more growth-oriented companies on the media side, so you’ll see more equity issuances, private placements, and PIPEs (private investments in public equities).

Mid-sized-to-large M&A deals are also more common because the regulatory environment is different, and governments don’t necessarily link media companies to “national security” in the same way.

If you work with legacy media companies, such as newspaper businesses and radio stations, you may also get exposure to restructuring and distressed M&A deals.

Finally, despite a few high-profile deals, leveraged buyouts are not particularly common in telecom or media.

Heavy regulation in telecom and the high uncertainty in media/entertainment make these companies less-than-ideal buyout candidates.

Media & Telecom Trends and Drivers

Since telecom is more of a “consumer staple,” while media and entertainment are closer to “consumer discretionary,” the trends also differ.

Key trends and drivers within telecom include:

- Government Policy and Regulation – Does the government restrict the company’s regions or the prices it can charge? How does it allocate spectrum availability and licenses?

- Upgrade Cycles and Devices – As people moved from landlines to early cell phones, growth opportunities shifted from wireline to wireless. Likewise, as they moved to smartphones and tablets and started consuming massive amounts of online video content, data subscriptions became more important than voice.

- Infrastructure Spending – These data subscriptions come at a high price, though: telecom companies must constantly maintain and upgrade their infrastructure as consumers start to expect higher speeds and better coverage (think: 5G).

- Price vs. Market Penetration – In developed markets, telecom companies tend to focus on boosting their ARPU (Average Revenue per User) with bundles and special data packages, while in emerging markets, they focus on increasing penetration rates. Since telecom is a high-fixed-cost industry, changes in ARPU often flow straight through to the bottom line.

- Broader Economic, Fiscal, and Monetary Conditions – As a more “defensive” sector, telecom tends to perform better than others when the economy is contracting, interest rates are rising, or unemployment is rising (but this one has become less true over time).

Similar trends, such as upgrade cycles and devices, influence the media and entertainment sectors.

But these industries are not regulated in the same way, they depend more on OpEx (employee salaries) than CapEx, and they tend to move in line with the rest of the market.

There are more growth opportunities in these sectors, but they also tend to be more “hit-driven” than telecom, with finite useful lives for most properties and higher churn rates.

Just think about how popular TV series start strong but often stumble into a black hole of awfulness by the end (I’m looking at you, Game of Thrones).

Because of this uncertainty, media and entertainment companies try to turn one-time purchases into subscription-based services whenever possible.

Even videogames, which were long considered a hit-driven business, are moving in that direction thanks to services like Xbox Game Pass and PlayStation Now.

TMT Overview by Vertical

Most banks combine their technology, media, and telecom groups, but since this article is all about media and telecom, we’ll focus on those verticals.

Telecom

Representative Large-Cap, Global, Public Companies: AT&T, Verizon, Deutsche Telekom, China Mobile, Nippon Telegraph and Telephone (NTT), T-Mobile, China Telecom, SoftBank, Vodafone, América Móvil, and Telefónica.

There is usually at least one large-cap public telecom company in each major country, which makes this vertical more globally diversified than the others.

For most of the 20th century, telecom was a very boring sector in the U.S. because AT&T owned ~90% of the market.

But that changed in the 1990s with deregulation and the internet, and it changed even more in the 2000s with smartphones and data plans.

These examples from Rogers Communications, the largest wireless provider in Canada, give you an idea of the key metrics:

For a telecom company to operate, it must maintain all its existing infrastructure, which means maintenance CapEx and a certain number of employees dedicated to existing assets.

If the company wants to grow, it must devote additional resources to that.

The tricky part is that market penetration and ARPU do not necessarily correlate 1:1 with the company’s growth CapEx.

More cables, towers, and satellites mean higher capacity, but not necessarily higher revenue; if the company builds these assets in poor locations, it might not earn much from them.

Companies can also grow their subscribers and ARPU without necessarily spending a fortune on capacity growth – it depends on the state of the market and the tech/upgrade cycle.

Media

Representative Large-Cap, Global, Public Companies: Netflix (??), Comcast, Charter Communications, ViacomCBS, Vivendi, DISH Network, WPP, Omnicom, Publicis, Fox, Discovery, and News Corp.

Media companies produce content, but this category also includes broadcast/cable TV companies like Comcast and Charter Communications, which are effectively telecom conglomerates that also do media.

This category also includes marketing/advertising companies like WPP, Omnicom, and Publicis, which could have completely different drivers despite the “media” label.

And then there are newspaper, magazine, and book publishers, many of which are owned by the larger conglomerates.

For content production companies, the key drivers are quite similar to telecom drivers at first glance.

The difference is the business model: the media company could charge consumers directly (Netflix) or make money from advertising and licensing (Discovery).

Revenue from advertisers tends to be more stable but has less upside and less potential for earnings surprises.

Since other large companies purchase this advertising, advertising-based media companies fall in the “B2B” category, even though their product is for consumers.

The key challenge with these companies is figuring out the links between content spending, subscriber growth, and subscription or advertising revenue.

Producing “more content” doesn’t necessarily result in higher numbers – it’s a matter of creating the right content that drives new subscribers and retains existing ones.

When M&A deals happen in the media sector, the motivation is often geographic and audience expansion:

If you’re analyzing advertising companies such as WPP and Omnicom, they’re closer to professional services firms: high variable costs, lower margins, and most revenue from large companies.

You might look at metrics like sales rep productivity, the “stickiness” of the company’s main clients, and average client size and spending.

Entertainment

Representative Large-Cap, Global, Public Companies: Disney, Nintendo, NetEase, Z Holdings (Japan), Kuaishou Technology, Spotify, Activision Blizzard, Sea Limited, Electronic Arts, Warner Music, and Tencent Music.

The line between “media” and “entertainment” is thin, and I’m not sure of the official distinction.

Looking at this list, the main difference seems to be that “entertainment” means “fun stuff for kids and adults” (videogames, music, and theme parks), while “media” means “serious content + occasional fun.”

Many entertainment companies are hit-driven and, therefore, are much harder to forecast than media and telecom firms.

For a notable example, take a look at how Nintendo’s fortunes changed between 2007 and 2017 as their videogame consoles changed:

If the entertainment company has a portfolio of franchises (the Marvel movies, Mario and Zelda, Call of Duty, etc.), you can link revenue and expenses to the release intervals and average sales per release.

And if the company has subscription services (Spotify, Disney+, etc.), the ARPU, subscriber count, net adds, and churn rate work as drivers.

If the company has neither of those, it’s similar to projecting revenue for a biotech company: throw darts at the dartboard and hope that some land close to the bullseye.

TMT Accounting, Valuation, and Financial Modeling

There are no huge differences in accounting, valuation, and financial modeling for telecom, media, and entertainment companies.

The main difference is that you tend to use different operational metrics, such as those described above.

Some companies may capitalize their content investments and amortize them over several years, resulting in Unlevered Free Cash Flow projections and 3-statement models that look slightly different.

The classic example is Netflix, which records “content assets” and “content liabilities”:

Netflix still has CapEx (see the bottom of that screenshot), but this content spending is the company’s major “business re-investment” item.

One valuation difference is that the Sum of the Parts (SOTP) method can be useful for telecom and media companies because many of these firms operate across different sectors.

For example, you’d almost certainly use Sum of the Parts to value companies like Disney or Vivendi.

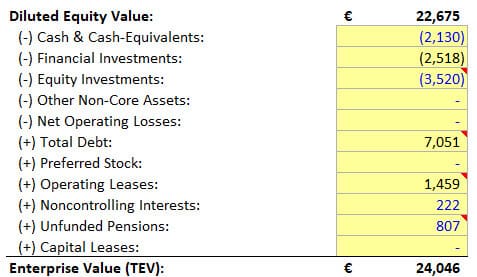

The Enterprise Value calculation can also be more complicated because these firms tend to have joint ventures and minority stakes in other companies (example for Vivendi shown below):

Here’s an example of Sum of the Parts from Lazard’s Singtel Fairness Opinion below:

Example Valuations, Pitch Books, Fairness Opinions, and Investor Presentations

And now to the best part of any “industry group” article on this site:

Telecom

Rogers Communications / Shaw Communications – CIBC and TD Securities

Singtel / Minority Stakes in Intouch and Bharti Telecom – Lazard Asia

Media

CBS / Viacom – LionTree, Morgan Stanley, Centerview, and Lazard

Meredith Corporation / Gray Television (Divestiture and Spin-Off) – Wells Fargo and Moelis

Mediaset / Mediaset España (Reverse Merger) – JPM and Citi

Entertainment

Cineworld / Cineplex (Cancelled) – BAML, GS, HSBC, and the Bank of Nova Scotia

Electronic Arts / Glu Mobile – JPM, GS, MS, and UBS

Activision Blizzard / King Digital – GS, BAML, and JPM

TMT Investment Banking League Tables: The Top Firms

It’s difficult to separate the top-ranked banks for media and telecom from the top banks for the TMT sector as a whole, so the commentary in the technology investment banking article applies here as well.

All the bulge bracket banks have a strong presence in this sector, and the “top 3” (GS, MS, and JPM) are especially prominent.

The elite boutiques also do well, which is why you see names like Lazard, Centerview, and Moelis advising on the transactions listed above.

Among the smaller banks, one difference is that certain firms may focus on one vertical within TMT.

For example, Qatalyst is very tech-focused, while Allen & Co., Raine Group, and LionTree do more in media and entertainment.

You won’t see many telecom-focused boutique investment banks because there’s less venture capital activity and startup formation there.

A quick search revealed names like Q Advisors and Alpina Capital, but their average deal sizes seem small, and I have no idea of their telecom vs. media/tech split.

Almost any boutique that wants to do telecom deals will brand itself as a “TMT investment bank” because telecom alone is too narrow a focus.

TMT Investment Banking Exit Opportunities

Similar to groups like technology and healthcare, media/telecom is not specialized, so all the standard exit opportunities are available, and you won’t be pigeonholed into specific industries.

The size and reputation of your bank make a much bigger difference than anything else, so, as usual, don’t expect to be competitive for the private equity mega-funds unless you’re at a top BB or EB bank.

Two differences compared with pure tech groups are:

- Venture capital exits may be less viable if you’ve worked purely with large telecom and media companies. Advising stable, highly regulated $50 billion companies on debt issuances doesn’t have much skill set overlap with startup investing.

- Restructuring/distressed/credit-related exits may be more viable, especially if you’ve worked with media companies such as declining newspapers and radio stations that need major business turnarounds.

For Further Reading

A few useful sources include:

- News: Fierce Telecom, Fierce Wireless, Fierce Video, FT – Media, FT – Telecoms, and Telecoms.com

- Industry Research: Signals Research (Wireless), Deloitte, PwC, and KPMG Media and Telecoms

- Books: Fisher Investments on Telecom

Pros and Cons of TMT Investment Banking

I hate to keep referencing the technology IB coverage on this site, but the advantages of media/telecom investment banking are quite similar: a variety of deal types, you won’t pigeonhole yourself, and the exit opportunities are broad.

If you compare media & telecom to technology, the main difference is that the most common deal types vary.

You’ll see many debt issuances from the big telecom companies, and you’ll get exposure to restructuring, turnarounds, and spin-offs if you work with legacy media companies.

But telecom “mega-deals” are far less common than tech mega-deals, so your M&A exposure won’t be quite as thorough.

Media has more diversified deal activity, but M&A mega-deals still tend to be less common than in tech.

So, TMT investment banking is one of the most desirable groups regardless of your interests and career goals, but it’s not the “perfect group.”

And although the internet seems to be infatuated with TMT, I don’t think it’s necessarily better than the other generalist industry groups.

Keep that in mind and try to avoid buying into the propaganda too much – or you might need a few self-help books to recover.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

Hi Brian,

Curious as to where the intersect would be between tech and telecom specifically? I’m looking to break into banking and I have extensive experience working on telecom / cloud deals in consulting — are there specific IB groups / specific banks I should focus on? (currently an incoming MBA student).

I think you will have to do some manual work/research to find these groups. I don’t think there’s an easy to filter for “deals that involve telecom and tech elements combined,” so you’ll probably have to look at some recent high-profile deals in the sector and look at the banks that advised on them and see if there are trends.

Hi Brian,

Thank you very much for such an amazing article! I just have one small question, what do you think of TD Securities’s CM&T group compared with this industry, in terms of comp/exit/culture? Thank you!

Sorry, but I’m not familiar with this specific group within TD, so I can’t really say.

Hey Brian.

I am very interested in sport- and film industry. Which group is right for me? Just wondering which PE or HF funds are big players in the sport or film sector?

Sports are usually a separate group: https://mergersandinquisitions.com/sports-investment-banking/

Films are within TMT, so they might match your interests. Not sure of the buy-side funds that do a lot of work in the space, but a quick search turned up this overview: https://www.crestview.com/news/151