Cold Calling Investment Banks: When to Do It, and How to Succeed

A few years ago, I was drawn into a Twitter fight.

A South African investment banker was tweeting about how a university student had interrupted him by cold calling to ask about internships in the middle of the day – while he was handling a client emergency.

Another student on Twitter then saw this banker’s complaints, replied, tagged me, and wrote, “But sites like M&I recommend cold calling all the time! So I guess they’re wrong! They’re wrong!!!!”

I realized this person’s reading comprehension was poor, so I decided to respond:

“To be clear, we recommend cold calling investment banks only as a last resort when everything else has failed, and only in very specific situations. Most people should use other networking strategies, such as informational interviews and cold emails.”

The people involved then deleted the entire thread, which is a shame – because this story illustrates the pitfalls of cold calling.

But before we get into the best uses of cold calling and the step-by-step process, let’s start with the basic definition:

Cold Calling Investment Banks: Defined

Technically, almost every networking interaction could be considered “cold.”

For example, if you message a stranger on LinkedIn or email someone new to request an informational interview, that’s “cold outreach.”

But in a cold call, you call someone to ask directly about an internship or job at their firm.

Cold calls are an investment banking network strategy, but they should be at the bottom of your priority list in ~95% of cases.

They work best if you are an undergrad or recent grad with limited or no work experience and you are looking for an internship at a small, local firm ASAP.

If you have even a few months of full-time work experience or even one finance-related internship, you’re better off using other strategies.

And you will rarely, if ever, get good results from cold calling larger firms (middle markets, elite boutiques, and bulge brackets).

To make this more concrete, someone with the following profile might find cold calling useful:

- University: Currently attending or graduated from a non-target school, such as a random state university outside the top 100 in the country.

- Grades: Somewhere in the “bad” to “acceptable” range, such as a 2.7 to 3.5 in the U.S. or a 2:2 to 2:1 in the U.K.

- Work Experience: Nothing relevant to finance; maybe typical part-time jobs in retail, doing tutoring, etc.

- Skills: Very good at talking on the phone and socializing but no deep knowledge of accounting, finance, or valuation.

- Time: Needs an internship ASAP because they’ve already graduated or summer break starts in a month or less.

This profile is the opposite of most aspiring bankers – and that’s why cold calls do not work well for most candidates.

Cold Calling Investment Banks: The Step-by-Step Process

If you decide to take the plunge, the process looks like this:

- Find the Names of Firms in Your Area and the Phone Numbers of Bankers – Paid databases such as Capital IQ are best, but you can also use simple Google searches or Google Maps. You will not be able to find individual bankers’ numbers at many firms, so you’ll have to settle on the main phone line and prepare to get past the gatekeepers.

- Prepare and Place Your Calls – You can give the same short pitch each time, but if you get a gatekeeper (secretary, assistant, etc.), be prepared to answer objections and politely ask for a banker or recruiter instead. If you do reach a banker, you’ll also have to answer objections and get them to request your resume/CV.

- Place Follow-Up Calls If You Don’t Reach a Banker – It’s worth trying a firm several times over a few weeks because you will get different results if you call on different days and at different times, and if you reach different gatekeepers.

- Go Through “Mini-Interviews” with the Bankers You Reach and Follow Up Again – Assuming you’ve successfully contacted a few bankers and submitted your resume, your goal is a “mini-interview” or informal “first-round interview.” If you don’t hear back quickly after submitting your resume, you’ll have to follow up again (via the phone or email).

Cold calling investment banks is a repetitive process, so speed is essential.

If your efforts drag on much longer than 1-2 months, you might go crazy – and you’ll almost certainly run out of boutique firms to contact.

The Effort Required for Cold Calls

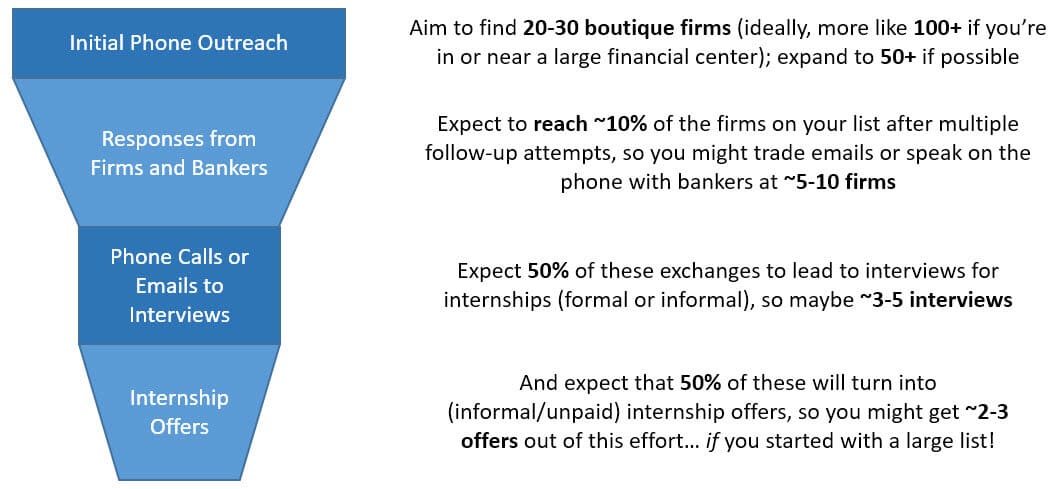

You can expect something like this if you’re in a region with at least a few dozen banks to call:

If you’re in a small town in the middle of nowhere, you might not be able to find 20 boutiques within several hours of you.

But if you call those few banks, you might get a very high response rate because they’re not used to students inquiring directly about internships.

If you’re in a place like NY or London, you can cold call hundreds of firms, but you’ll also get a much lower response rate.

Cold Calling Investment Banks in Steps

Here’s a bit more about each step in the process:

Find the Names of Firms and the Phone Numbers of Bankers

There isn’t much to say about searching for firm names, assuming you know how to use a keyboard and the internet.

One question is which bankers to target: Analysts? Associates? VPs? MDs? Everyone?

Ideally, you should target MDs or Partners because they have the most hiring power.

However, they’re also more difficult to reach, so targeting VPs and Associates is reasonable if you cannot find names or contact information for the most senior bankers.

And if you cannot find the contact information of any bankers, you’ll have to try the firm’s main phone line (see the next section).

If you’re in a smaller city, state, or province, you can aim to find 20-30 firms before you start placing calls.

If you’re in a larger region with more firms, maybe aim for ~50 before starting.

You’ll need a tracking template as well, but it can be very simple for cold calls.

Prepare and Place Your Calls

You’ll need to prepare three main items:

- Your Quick Pitch – This must be very short (1-2 sentences).

- Gatekeeper Bypass Plan – If you get an assistant, secretary, or another non-banker, how will you get past them?

- Responses to Typical Banker Objections – How will you respond when they say they’re not hiring, don’t offer internships, or can’t afford interns?

You could use something like this for your quick pitch if you reach a banker:

“I know you’re busy, so I won’t take too much of your time – I’m a [Major] student at [University Name], and I’ve worked at [Company Names] before. I wanted to see how I could best position myself for an internship at your firm.”

If you get a gatekeeper, you could try a slightly shorter version:

“Hello. This is [Your Name], a [Major] Major at [University Name]. I wanted to call and ask how I could apply for internships at [Firm Name].”

In ~95% of cases, you will get an objection to your initial pitch, such as:

- “We’re not hiring.”

- “We don’t offer internships.”

- “We’ve already hired interns for the summer.”

- “Interns can’t add any value.”

- “We don’t have the budget for interns.”

The responses vary based on the objection, but here are a few examples:

- “We’re not hiring.” –> “I see. So, you’re in charge of recruiting for the firm?”

- “Well, no…” –> “OK, would you mind connecting me to the team member who leads your recruiting efforts?”

- “We already have a summer intern.” –> “I understand, but if your deal flow picks up, I could contribute to specific deals or client projects, and you wouldn’t need to train me.”

When responding to objections, it helps to make statements or ask open-ended questions rather than ones with simple yes/no answers.

For example, don’t say, “Do you offer internships?” but rather, “I wanted to ask about how to apply for internships at your firm.”

There are various other tricks; for example, if you get a banker’s voicemail, you could hang up, call back, say you got disconnected, and ask for the person’s email or direct phone #.

If you reach a gatekeeper who is truly unhelpful or hostile, end the call, and try again on a different day or at a different time.

Place Follow-Up Calls If You Don’t Reach a Banker

Quick follow-up is quite important here because you’re working on a short time frame.

It’s worth following up in 2-3 days if you did not get a response or could not connect with a banker or recruiter.

If you’ve already tried several times via the phone, switch to email and see if you get a response that way.

Here’s what you might expect if you’ve found 10 boutique firms in your area and you’re aiming for an internship in the next 1-2 months:

- Week 1: Call all 10 banks, reach bankers at 2 firms, and submit your resume/CV. Send a note to the 2 bankers 2-3 days after sending your resume, and place follow-up calls with the other 8 banks, finally reaching bankers at 2 / 8 banks.

- Week 2: Send a message or place a follow-up call to the 4 bankers that responded to you, and try again with the other 6 banks, still getting nowhere. Only one of the 4 bankers continues to be responsive, so you set up a “mini-interview” call for next week.

- Week 3: You do the “mini-interview” with the responsive banker. A banker at another firm finally becomes responsive, so you do a quick interview there as well. Unfortunately, the other 2 bankers who previously responded are now ghosting you.

- Week 4: You focus on the 2 firms where you’ve “interviewed” and check back every few days to see if they have updates. You plan to follow up with the ~8 unresponsive firms next week so that you have a backup plan.

Go Through “Mini-Interviews” with the Bankers You Reach and Follow Up Again

These will be fairly similar to standard investment banking interviews, but the technical questions will be easier (lower expectations).

Most of the questions will be about topics such as:

- “What can you do for us? How could an intern save us time or money?”

- “How is your previous experience relevant to investment banking?”

- “Do you know what investment bankers do? What is a pitch book? How does an M&A deal work?”

They’re checking to see if you’ve done the bare minimum required to work in the industry.

They may not even ask you for a full resume walk-through, but it varies based on the time allotted.

Afterward, you return to “follow-up mode” and contact the banker each week until you hear something:

SUBJECT: RE: [Insert your original subject line here by replying to your first email]

“Mr. / Ms. [Name],

Thanks for taking the time to speak with me [# Days/Weeks Ago] about potential [Time Period] internships at [Firm Name] (as a reminder, I am [Summarize your academic and work experience]).

I previously submitted my [resume/CV] but have not heard back regarding my status or the next steps in the process, so I wanted to follow up with you and check once again.

Thanks for your time, and I look forward to hearing from you soon.

Best regards,

[Your Name]”

If you’ve tried following up 2-3 times over several weeks and still haven’t heard anything, focus on other firms for now.

When Cold Calling Investment Banks Goes Horribly Wrong

As you can see, cold calling is a boring, repetitive process.

But there’s another problem as well: if you don’t place your calls very carefully, there’s a chance they could go horribly wrong – like what happened in the story at the top of this article.

People in finance often handle emergencies and do not like to be interrupted by students asking about internships.

So, if you get a very negative response, you should also be prepared with an “escape plan” that lets you exit the conversion quickly.

This could be as simple as saying thanks, sorry for the disruption, and promising that you’ll follow up with someone different.

I wouldn’t say it’s common to reach an angry banker who screams at you, but it’s within the range of plausible outcomes.

For Further Learning About Cold Calling Investment Banks

If you follow the strategies and tactics in this article, you’ll be in good shape to cold call investment banks (if you’re one of the few who might benefit from this strategy).

But if you want even more, including sample scripts, email templates, and examples of cold calls placed to both gatekeepers and bankers, you can get it in the IB Networking Toolkit:

IB Networking Toolkit

Win investment banking interviews with dozens of templates, examples, and guides for informational interviews, cold emails, cold calls, and more.

learn moreI would not recommend cold calling to most job seekers, but it can be effective in specific situations.

Just avoid annoying bankers enough to start a Twitter fight, and you might even escape the effort alive.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews