Restructuring Investment Banking: The Perfect Panacea for Plagues, Pandemics, and Pandemonium?

Whenever there’s a recession, downturn, or market crash, everyone in finance gets the same idea: Break into Restructuring or distressed investing!

I wouldn’t be shocked if search traffic for terms like “restructuring investment banking” doubles or triples in these times.

It’s not entirely irrational: Restructuring and distressed groups are the best places to be in downturns…

…but they are also not universal solutions.

Most groups are small, with limited recruiting, and it’s tough to break in as a lateral hire unless you have directly relevant experience.

Also, depending on the catalyst that triggers the downturn, Restructuring teams may not be able to do much to help companies stay afloat.

And if the company dies, it’s a good bet that your “success fee” will be… not so great.

We’ll cover all of that and more in this comprehensive guide to restructuring investment banking – but first, a few key definitions:

- What is Restructuring Investment Banking?

- What Causes “Stress” or “Distress”?

- Financial Restructuring: What Can Bankers Do About the Distress?

- Restructuring Valuation and Financial Modeling Work

- Who Breaks Into Restructuring Investment Banking?

- Restructuring Interview Questions

- The Top Restructuring Investment Banks

- Restructuring Investment Banking Salary Levels

- Restructuring Exit Opportunities

- For Further Learning

- Restructuring Investment Banking: Pros and Cons

What is Restructuring Investment Banking?

Restructuring Investment Banking Definition: In Restructuring IB, bankers advise companies (debtors) on deals to modify their capital structures so that they can survive; they also work on bankruptcies, liquidations, and distressed sales, and they may advise the creditors, rather than the debtor, on each deal.

Just as there are sell-side and buy-side M&A deals, there are also two “sides” in Restructuring (RX) and distressed transactions: the debtors (companies) and the creditors.

A bank advises only one side in each deal, and some groups tend to focus on one specific side across all transactions.

Any debtor (company) that engages a restructuring group is in one of the following categories:

- Stressed – The company is still able to pay interest on its debt, but it may have trouble with an upcoming maturity (repayment of the debt principal) – or it may be heading toward a cash crunch.

- Distressed – The company has already defaulted by missing an interest or principal payment or maturity, or it has violated a covenant, such as a minimum EBITDA / Interest requirement.

- Bankrupt – The company has already entered a Chapter 7 (liquidation) or Chapter 11 (reorganization) process and wants to achieve the best possible outcome.

I wrote “company” above, but restructuring groups might also advise governments and governmental entities that are facing similar troubles (see: Greece, Latin America, etc.).

Governments often run into similar situations when there’s a currency crisis or political upheaval, and the country has significant amounts of debt denominated in other currencies.

On the other side, the creditors in a restructuring deal might include banks, bondholders, and subordinated and mezzanine lenders.

When advising creditors, banks will try to get them the best possible terms, which might mean the highest “recovery” (repayment percentage) possible, or, in the case of a debt-for-equity swap, a higher percentage of equity.

In some cases, changing the company’s capital structure is not the answer; for example, a struggling retailer might need to shut down unprofitable locations to survive.

In those cases, restructuring consultants might come in to advise the company.

But bankers might still be involved if the company needs to raise extra capital at the same time.

Unlike M&A, industry groups, ECM, DCM, and Leveraged Finance, Restructuring is more about minimizing losses than maximizing value.

That means you need to think like an investor and understand the risk factors in-depth – whether you’re advising the debtor or the creditors.

You also need to understand both debt and equity and the entire legal process involved in reorganizations, liquidations, and bankruptcies, which makes the group unique.

The process itself is also quite complicated because you must balance the needs of each group and figure out a compromise that lets the company survive while also giving creditors the yields they are seeking.

Assuming that the company is not about to die, deals can sometimes last for 12+ months and involve intense negotiations back and forth; you might work on fewer simultaneous transactions than in other groups because each one requires your full attention.

What Causes “Stress” or “Distress”?

The broad trends that cause a company to become distressed are usually:

- Structural/Industry Disruption – Think about Netflix and Blockbuster, Apple and RIM, or Amazon and every single non-Amazon retailer in the world.

- Macro Shock – A geopolitical event, war, monetary/fiscal crisis, energy crisis, or, yes, a pandemic.

- Poor Company/Management Decisions – The CEO tries to expand too quickly, the company takes on too much debt, or it introduces policies that worsen its cash-collection cycle.

Once a company is already suffering from one of these, a specific catalyst comes along to push it into the “distressed” category. Common ones include:

- Missed Interest Payment – The company lacks the cash to pay interest on its bonds, so it “skips” a payment. Creditors notice.

- Missed Principal Repayment – Similar to the above, but more dangerous because now the creditors are losing money rather than failing to earn money.

- Violated Covenant – The company’s sales are falling, so it breaks the maximum Debt / EBITDA on one of its loans as its EBITDA declines and its Debt stays the same.

- Credit Rating Downgrade – The rating agencies downgrade the company’s bonds from investment-grade to junk because they expect the company’s liquidity and credit stats and ratios to worsen.

- Declining Cash Balance – The company’s sales and margins keep falling, and if it continues on this path, it won’t be able to make payroll or pay suppliers by the end of the year.

Financial Restructuring: What Can Bankers Do About the Distress?

A distressed company has several options, each of which results in a different deal type:

- Chapter 7 Assignments: These involve significant valuation work because you assess the market value of each asset, find potential buyers, and then help the company liquidate by selling its assets to repay as many of its liabilities as it can.

- Chapter 11 Assignments: You help the company change the terms of its debt, possibly raise new debt or equity, and eventually repay its original creditors. There may also be a debt-for-equity swap or other significant changes, such as the original shareholders being completely wiped out.

- Out-of-Court Assignments: These let a company avoid or postpone a formal bankruptcy filing, and they reduce operational disruption, but the company also loses some flexibility and negotiating leverage.

- Distressed Sale – If the options above do not work, then the company may have to pursue a quick sale process where it tries to attract interest from any willing buyers, accepting a steep discount in the process.

There are several other deal types as well, such as a Section 363 asset sale (a faster / less risky form of a standard asset sale), as well as a “general assignment” (a quicker alternative to bankruptcy).

If you’re advising the creditors or buyer(s) in these deals, you put on your “due diligence” hat and look for reasons the company will not be able to pay off its Debt, or reasons why the company’s assets are worth less than the company claims.

Often, that means reviewing their historical cash flow, customer/supplier contracts, and legal agreements in depth.

As a junior banker working on these deals, you read a lot of credit agreements (“indenture analysis”), track covenants and other deal terms, and do modeling/valuation work to assess the potential outcomes.

When you’re advising the debtor, it’s similar to a sell-side M&A deal, where you tell the company’s story and explain how it will come back to life and eventually repay its debt.

Creditor mandates are more like buy-side M&A deals, where you poke holes in that story and push for better terms.

Restructuring Valuation and Financial Modeling Work

If you’re valuing a distressed company, all the standard methodologies still apply: comparable company analysis, precedent transactions, and the Discounted Cash Flow (DCF) based on Unlevered Free Cash Flow… but there are some differences.

For example, you might have to adjust a company’s expenses if it has unusually high COGS due to supplier problems, or if it had to furlough employees to stay afloat.

You may also need to adjust the Change in Working Capital because the company may be less likely to collect receivables, and it might have to pay suppliers more quickly than usual.

You tend to focus on Enterprise Value-based methodologies and multiples because a distressed company’s equity is often worth disproportionately less than usual (see: how to calculate Enterprise Value).

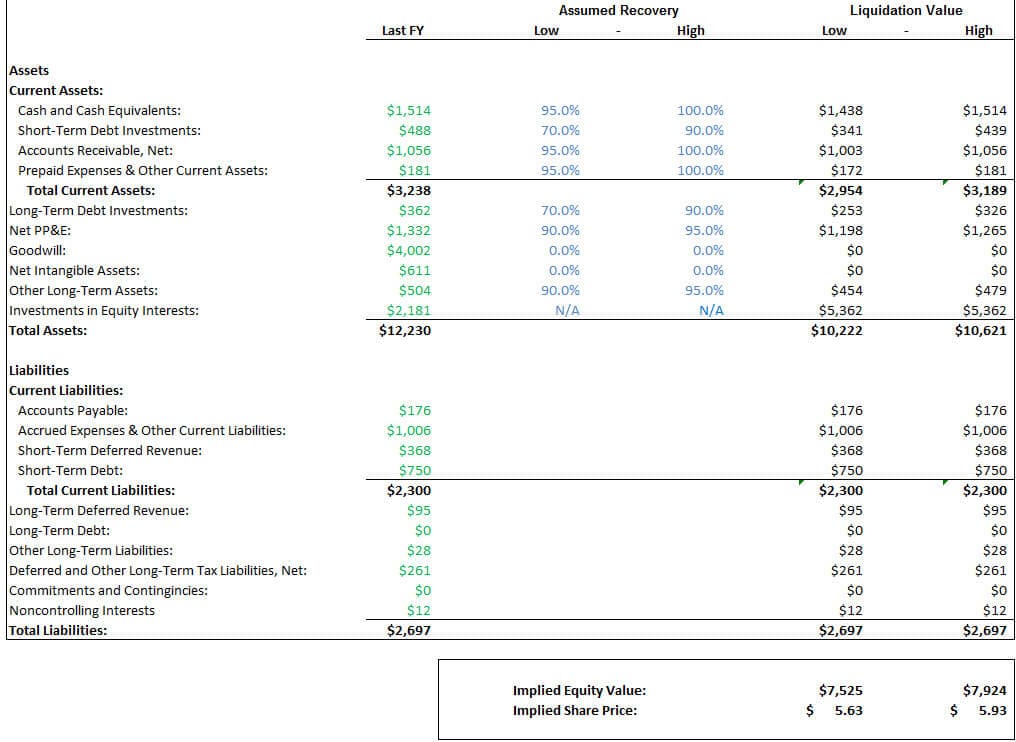

And then there’s the Liquidation Valuation, where you assume that all the company’s assets are sold to pay off its liabilities.

You assume a “Recovery Factor” for each asset to estimate its market value; Cash might have a Recovery Factor of 100%, but late AR might have a value of only 60-80%. And Goodwill is always 0% because it cannot be sold.

Then, you add up the market values of all the assets and then subtract the liabilities, making sure that the most senior creditors are repaid first.

You can see a non-distressed example for a healthy company below:

Outside of valuation, there are credit analysis methodologies as well.

For example, you could look at traditional credit stats and ratios such as the leverage ratio, interest coverage ratio, and cash interest coverage ratio, and see how they change in different operational cases (example for Central Japan Railway below):

You could also look at these in the context of covenants and calculate a “cushion” for each one to assess the chances of covenants being broken.

Understanding bond yields and pricing is important because you use them to determine how the implied return to bondholders changes if the terms of the debt change (see: how to approximate the Yield to Maturity).

(For more, please see our full tutorials on the bond yield, the Current Yield, the Yield to Maturity, the Yield to Call, and the Yield to Worst.)

Then there’s the Liquidity Analysis – not to be confused with the Liquidation Valuation – where you project a company’s monthly or quarterly cash flows and use them to estimate when the company might have to draw on its Revolver or raise additional funds.

For example, if the company has a $50 million Revolver with $0 currently drawn, and it’s projected to burn $5 million in cash per month, it will need to raise additional funding within the next 10 months.

As part of this analysis, you might also calculate the most common liquidity ratios, such as the current ratio, quick ratio, and cash ratio; the Cash Conversion Cycle might also be a part of it.

In a Recovery or Hurdle Analysis, you assume that a company gets sold for a certain EBIT, EBITDA, or EBITDAR multiple and then uses the proceeds to repay creditors.

You arrange the creditors in order of seniority and assess the repayment percentages (“recoveries”) to each one under different multiples and operational scenarios.

For example, if a company has EBITDA of $200 million and gets sold for 5x EBITDA, that’s a $1 billion Enterprise Value.

It also has a Revolver of $100 million, a Term Loan A of $200 million, and Unsecured Senior Notes of $1 billion (all face values – not market values).

In this case, the secured creditors get a recovery of 100% because the $1 billion in proceeds can repay the Revolver and Term Loan A in full.

But only $700 million is left for the Unsecured Senior Note investors, so their implied recovery is 70%.

You can see an example for a real estate deal with senior loans, mezzanine, and preferred stock below (based on exit dates rather than exit multiples, but the idea is the same):

OK, But How Do You Use All These Analyses to Advise Distressed Companies?

Let’s say a company has a 13% coupon bond that is set to mature in ~2 years.

The bond is currently trading at 80% of par value because the market doubts the company’s credit quality.

As a result, its Current Yield is ~16%, and its Yield to Maturity is ~25%:

The company is experiencing a downturn in a highly cyclical industry and requests an extension so it can have 2 extra years to repay the bond.

In exchange, it will agree to a 14% coupon rate instead.

If it’s just a simple 2-year extension with a slightly higher coupon rate, the YTM to the bondholders will decline to ~21%:

Existing investors are not happy with this outcome, so you propose that the company also add an initial equity grant of 10%, rising to 25% over 2 years.

You also propose a redemption premium of 10%, i.e., the company will repay 110% of the bond’s par value upon maturity rather than the normal 100%.

If the company’s Equity Value rises from $150 in Year 1 to $200 in Year 2, and it makes its interest payments, repays at 110% of par value, and grants equity to the bondholders, the Yield to Exit increases to ~25% (the YTM does not include the equity grant, so Yield to Exit is the relevant one here):

This simplified example is restructuring in a nutshell: find a compromise that allows the company to survive and which also allows investors to earn a yield in-line with their original expectations.

Who Breaks Into Restructuring Investment Banking?

Often, bankers join Restructuring groups from other groups at the bank, such as industry teams, M&A, and Leveraged Finance.

Since legal knowledge is essential, many corporate lawyers also make the jump; they’re much better at reading and interpreting long/boring contracts than bankers.

Restructuring consultants and anyone with a distressed debt background could also potentially get in.

Since these groups are small and do not exist at most bulge bracket banks, the top groups in the U.S. might hire several dozen full-time Analysts each year (vs. hundreds or 1,000+ in all other groups combined).

They bring on more summer interns than that, but only a percentage of them receive full-time return offers.

If the economy is booming and very few companies are distressed, Restructuring bankers are often transferred or re-assigned to groups with more activity; they might then be shifted back if the economy nosedives.

The skill set is useful in any group that’s credit-related, whether it’s LevFin or a coverage group that does many debt deals, such as industrials.

Restructuring Interview Questions

The biggest misconception here is that “everything is different” just because it’s Restructuring.

That is not true at all: you will still get the standard investment banking interview questions about accounting, valuation, M&A, and LBO models, along with debt vs. equity analysis and credit questions.

Yes, you should read up on the key terms and jargon (e.g., Chapter 7 vs. 11, debtor-in-possession (DIP) financing, etc.), and you should read the infamous Houlihan Lokey distressed case study.

But don’t assume that every single interview question will involve an obscure legal concept or credit term that’s specific to Restructuring.

The Top Restructuring Investment Banks

The bulge brackets have very little presence in this area for several reasons:

- Scale and large Balance Sheets don’t give the big banks an advantage because RX deals are mostly about negotiating successfully with a small group.

- It’s “off-brand” for their image.

- Conflicts of interest can come up more easily at the large banks because another group might be advising the opposite side in a deal or have some interest in it.

So, the top Restructuring banks tend to be the elite boutiques and middle market firms.

Think: PJT, Houlihan Lokey, Lazard, Evercore, Moelis, Guggenheim, Centerview, Rothschild, Greenhill, Perella Weinberg, Jefferies, and Miller Buckfire (acquired by Stifel).

There are some newer entrants as well, such as Ducera, which was founded by former bankers from some of those firms.

Some of the Big 4 firms also work in this area, and there are turnaround consulting firms such as FTI Consulting, Alvarez & Marsal, and AlixPartners.

McKinsey RTS, BRG, and a few others also operate in the space.

You should not rely on “league tables” to judge the quality of a Restructuring group because the work is specialized and cyclical, and many organizations do not track RX deals separately.

For example, many deals are settled out of court or in simple credit agreement updates without press releases.

Sources that track deal activity might miss these transactions completely since you can’t find much about them on Google or news sources.

Your best bet is to look at the group’s recent deals and ask alumni and current staff about the environment there.

Restructuring Investment Banking Salary Levels

Salaries and bonuses are not that much different at the junior levels; the differences arise because elite boutiques often pay higher bonuses than bulge brackets.

So, you might earn a higher bonus working in RX at Evercore than in TMT at Morgan Stanley, but you also would have earned more in an M&A or industry group there.

However, pay can be significantly better at the senior levels because the group is specialized, and it’s easier to “take credit” for your performance.

On equity and M&A deals, many other bankers will try to take credit for the relationship or parts of the deal process.

But in a tightly negotiated credit agreement or debt-for-equity swap, bankers from ECM or an industry coverage group cannot claim that they had anything to do with the transaction.

On the other hand, Restructuring is counter-cyclical, with highly variable deal activity.

So, an MD could earn mediocre bonuses for years, only to reap a windfall in that one year when a recession or depression finally begins.

Restructuring groups usually charge clients like this:

- Monthly Retainer – This might be $100-$300K+ for large companies.

- “Success” Fee on the Transaction – This will be similar to the low, single-digit percentages charged in M&A deals.

- Fees on New Equity and Debt Raised – These are often a bit higher than the standard fee percentages because it’s more challenging to raise funds for distressed companies.

So, the bank will always earn something from the monthly retainer, but the real money comes from closing deals and raising additional capital.

The main downside to working in Restructuring is that the hours can be very long – even worse than regular IB hours – because many groups have a “sweatshop” reputation.

And they’re not going to pay you 30-40% more at the junior levels just because you worked 100 hours this week rather than 70-80.

Restructuring Exit Opportunities

Since you gain experience with M&A deal processes, valuations, and credit analyses, you have a wide range of exit opportunities.

You could easily join any other group at a bank, you could move to a distressed debt hedge fund, a credit fund, or a mezzanine fund, or you could move into PE (both normal and distressed private equity).

Even opportunities outside the distressed space are available because much of what you do is the standard analysis of equity and debt.

You probably wouldn’t be the best candidate for venture capital jobs, but most other roles are wide open.

For Further Learning

No, we do not have a dedicated Restructuring course.

I wish we did, but the numbers never worked (it’s a very niche product that would also be expensive to develop and maintain over a 30-year lifespan).

The other issue is that a lot of the work in Restructuring happens outside of Excel and PowerPoint in the form of reading long, boring credit agreements.

It’s extremely difficult to “teach” that type of skill with online videos or written guides; it just requires practice.

On the modeling/valuation side, most of what you do in Restructuring consists of “credit analysis” and “debt vs. equity analysis,” and we do cover those topics in the Advanced Financial Modeling course and the IB Interview Guide:

Advanced Financial Modeling

Learn more complex "on the job" investment banking models and complete private equity, hedge fund, and credit case studies to win buy-side job offers.

learn moreThere are relevant case studies and examples for companies like EasyJet, Netflix, and Central Japan Railway.

If you want a book, the classic reference is Moyer’s guide to Distressed Debt Analysis.

Yes, it’s “old,” but the core principles never go out of date – even if specific accounting rules change slightly.

Finally, another free source is the Distressed Debt Investing blog. It’s not updated anymore, so it’s also “old” (dating to the 2008 crisis), but again, the principles stay the same over time.

Restructuring Investment Banking: Pros and Cons

I would summarize everything above as follows:

Pros

- Arguably the most interesting work of any group in investment banking, and you’ll get significant exposure to valuation and financial modeling.

- A wide range of exit opportunities; broader than almost any other group.

- You will tend to work on fewer pitches and more live deals, and you’ll get more in-depth exposure to each transaction.

- You’ll gain useful skills for buy-side roles, especially if you work on many creditor mandates.

- As a career banker, the earnings potential in Restructuring is very high if you stick with it and wait for downturns to happen.

Cons

- The group is counter-cyclical, and you may not get much deal experience in times of economic expansion with few distressed companies.

- Few bulge bracket banks operate in this area, so you’ll be limited to working at elite boutique and middle market firms.

- Team sizes tend to be small, and they don’t necessarily hire a ton of Analysts and Associates even when deal activity picks up; also, you usually need directly relevant experience to break in as a lateral hire.

- The hours are often longer than in other groups, but the pay isn’t much different until you become more senior.

- You can’t necessarily solve a company’s problems if its distress was triggered by something like a war or pandemic; if bombs have destroyed all the infrastructure, there isn’t much to “restructure.”

The bottom line: Yes, Restructuring is the best group during a downturn, recession, or market crash, but it’s not a panacea.

If overall deal activity falls by 50%, an increase in distressed deals will not make up for that lost volume, especially once you factor in all the $10 billion+ transactions that get canceled.

You could make the case that Restructuring at the elite boutiques is the best entry-level role in IB, but you also have to accept longer and more grueling hours if you go that route.

And as a career banker, it can be very lucrative… as long as you’re OK with periods of low deal activity and small bonuses during economic expansions.

So, if you’ve already won a role in Restructuring, great.

But if not, don’t count on Restructuring to provide a career shield made of adamantium – only Wolverine could do that.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

I’m starting as an analyst in one of the RX groups you named above. Can you elaborate more on the exit ops found within RX? Are analysts pigeonholed into distressed investing, or is corporate PE possible as well? I’m also considering doing A2A and career banking. Are there any substantial differences in career banking in RX vs M&A? I would assume that it would be harder to make the jump from say VP to anything above that during a bull market while such a move would be easier in M&A given the cyclicality.

Do banks have layoffs in RX teams during bull markets? Thanks

You can move into generalist PE roles because the usual perception is that Restructuring is more difficult/technical than standard M&A roles. Banks do not necessarily “fire” their Restructuring teams when the market is good, but they may move people around and put them in different groups if there’s more demand elsewhere. The biggest issue with Restructuring as a long-term career is that the pay fluctuates a lot at the senior levels, so you normally have to stick with it for 10+ years to see a huge benefit. If you just stay for a few years, you might be in the market at a bad time and earn poor bonuses.

Leveraged Finance Associate looking to make the lateral jump into RX IB. Current experience is not that modelling intensive or anything to do with Ch 7/11. Have worked mainly on credit origination i.e. issuing term loans and HY bonds for corporate firms. Looking for RX experience to make me a more well rounded debt advisor/specialist. Any specific guidance on how I can prepare best to make make candidacy competitive ?

I’m not sure I can add much that you don’t already know. Your main options are learning more about modeling/credit analysis independently and/or spinning your existing deals to look more analytically intensive. There are some recommended resources here (the Moyer reference, etc.) and probably a few RX-focused courses and case studies you can find online. But no matter what you do, you will probably have to spin some of your deal experience into sounding like you advised “stressed” companies so that it sounds a bit closer to distressed, even if that’s an exaggeration.

Thank you very much. Appreciate the spinning the story part.

Most excellent review. I work for a bankruptcy administrator. Often times the investment banker will suggest to the debtor attorney which third party administrator to use when going into Chapter 11.

Do you know where I could buy a list of said investment bankers? Many thanks.

Thanks. Sorry, we don’t track debtor attorneys or 3rd party administrators.

Hi Brian, Thank you for your great informative blog. In order to increase your chances of getting hired in the area of Restructuring Investment Banking, what licenses would you recommend? Series 7, Series 79, or Series 82? One last question, what other licenses or certificates, would you say is necessary? Thank you.

None of the above. See: https://mergersandinquisitions.com/investment-banking-certification/

Hi Brian – first an excellent article on overall RX work (which I started 2 decades ago). If I may chime in on 2 further points:

Hours – its horrible and I did RX work as IB analyst with one of the largest global commercial bank. As I was still rotating under this IB Analyst program (DCM), due to severe economic downturn and massive defaults in Commodities sector; RX team was severely short staffed. I had prior background in Barings investigation, hence was immediately reassigned. I was stuck in lawyers and accountants offices to vote on schemes, negotiate till dawn. However, the training is great because you learn quickly how to manage stakeholders with shifting interests.

Skills – After the dreadful hours, I made great industry connections and moved into Commodities sector and became a Trader within top tier IB and trading firms and continue to shuffle between RX and Origination work. Technical skills aside, you will hone negotiation skills and stamina; ability to distil complex data into simple facts. I got my chartered accountant designation as well

In conclusion, not an easy start (as hours easily exceed 90hrs) but rewards are tremendous.

Thanks for adding those points.

Hi Brian,

I am trying to secure an analyst position in restructuring and have a question about interviews.

Interviewers often ask me if I have been to any of the bank’s networking events at my uni. I have been to several of these events…but I havent kept in touch with the bankers I met there and have forgotten their names. I am therefore afraid to tell them I have indeed been to their events in case they ask me who I met and I cant tell them the names of the bankers I met!!

If an interviewer asks me who I met, can I be honest and tell them I dont remember their names?

Yes, just say you don’t remember specific names but you did attend some of the networking events.

Hi Brian,

Thank you for a very comprehensive and insightful post. I actually work in this field (direct competitor to FTI in Indonesia), but am surprised to see that you regard it as a good group to be in in terms of exit opps and learning opportunities.

I am curious as to how you think this experience would be perceived from other perspectives (MBA, growth private equity, management consulting, etc) as I have mostly worked with distressed companies looking to keep their sinking ships afloat or escape from them altogether. My engagements were mostly from the debtor side and involved a lot of long term modeling, equity valuation, returns waterfall and recovery analysis, and 13 weeks cash flow modeling to explore operational options (sale of stores, business units, laying off employees, extending payments). Do you think these experiences can still be leveraged for growth-oriented roles like growth PE or would I need an MBA to do that? Thanks so much for everything!

To clarify, turnaround consulting firms like FTI are in a bit of a different category because they don’t work on “deals” in the same way as restructuring IB groups. I don’t think you could use the experience to get into growth PE roles or other growth-oriented roles that easily. For more, see: https://mergersandinquisitions.com/restructuring-turnaround-consulting/

Hi, great posts I just wanted to ask you what you think about investment banking in Iran. Im finishing highschool this year and Im intrested in IB, I just don’t know if its a good idea to stay in Iran or just move to Germany or sth.

Sorry, we have no information on IB in Iran. I would assume that it’s a very small industry given the size of the economy, the sanctions on the country, etc. So you are better off going to larger markets such as Europe.

Brian – this is incredible. Thanks so much for all of your help. These articles are so easy to read while being incredibly informative and effectively structured. A few questions below:

1 – Is the distressed companies unusually low equity value due to how low they’re being traded at? Or are private companies equity value also incredibly low – and if so, why is that?

2- Are the hours typically worse due to the difficult nature of restructuring? Or is it more so due to the fact that bankers are working on more live deals than pitches?

3 – For someone who will be interning in Rx IB, how would you recommend the Moyer book as opposed to reading up on Rx case studies, familiarizing oneself with Ch. 7 & 11, and other financial modeling exercises?

Thanks again for the help!

Thanks.

1) Any type of distressed company will have a very low share price and a much-lower-than-normal Equity Value, but it’s most visible with public companies because share prices change very quickly there. You can’t see it as readily with private companies (which still have share counts and share prices) because the shares are illiquid and it’s not easy to determine the share price unless the company has just raised funding or been sold. Equity Value declines massively for distressed companies because if a company declares bankruptcy or restructures, the common shareholders are often wiped out and lose everything.

2) It’s a bit of both, plus the fact that there is often a “timer” with RX deals. If the company doesn’t negotiate terms by Date X, the company dies. That doesn’t really happen with standard M&A or capital markets deals, so there are fewer deadlines.

3) Depends on how much you already know. Priority #1 should always be to get very good with Excel/PowerPoint and to master normal accounting, valuation, and credit analysis. Do that first before reading Moyer or completing RX case studies.

If you’ve already done that or can answer questions about those topics without thinking, then you can move onto the rest.

Second! Excellent article.

Hey Brian – amazing article. Just have a couple quick questions:

1) Is it true that the overall pay at those restructuring firms like Alix, FTI and Alvarez & Marsal are a lot lower than investment banks at junior level? How much do those firms typically pay analysts and associates?

2) Do you need to obtain some sort of relevant designation (CIRP for instance) in order to advance within the restructuring shops?

Thanks.

1) Yes, pay is lower at restructuring/turnaround consulting firms. Figures from a few years ago (https://mergersandinquisitions.com/restructuring-turnaround-consulting/) were $140-$170K at the Associate level due to much lower bonuses, so I would assume Analysts are closer to $100K all-in.

2) No. Outside the CFA, no other certification means much of anything in these roles.

Thanks Brian. Just to follow-up:

1) Is it doable to transition from FTI/Alvarez & Marsal to the investment banks’ restructuring teams later on (for better comps etc)?

2) Heard that there’s quiet a bit of admin work needs to be done working in restructuring (aka managing payables for the debtor etc) – is that the case?

3) What could be some potential exit opps?

Thanks!

1) Yes.

2) Yes.

3) There is a good list in this interview: https://mergersandinquisitions.com/restructuring-turnaround-consulting/

Hi Brian,

Thank you very much for these explications:

All the images/examples are from the Central Japan Railway case study ?

No. A mix of examples from the Fundamentals, Advanced, and Real Estate courses, and the Interview Guide (which has the Central Japan Railway case study).

Is there an age limit or cut off for entering the.industry ?

https://mergersandinquisitions.com/age-investment-banking/

https://mergersandinquisitions.com/too-old-for-finance/

In this particular economic downturn, would healthcare groups be good to be in as well?

Potentially, yes, but deal activity everywhere slows down. It’s not like healthcare has a magic shield just because some healthcare companies might benefit from pandemic treatments – plenty of others (nursing homes, hospitals, etc.) will suffer. You’re better off in healthcare than in industrials, but it’s not necessarily a night-and-day difference.

Thanks :)

Hi Brian, I know that my question is not directly related to this article but I would really like to have your opinion. I am a student in France and as you may know, the school system is quite different here. I’m going to start my graduate studies next year after two years of “prepa” and they last four years so I have time to do lots of internships and I already know that I am interested in IB. However, I would also like to see what it’s like to work in VC or PE firms or even in tech firms. Would you advise me to do internships in each of these areas to try – which would enable me to know if I want to leave IB after a few years or if I wanna stay there – or does this deviate me too much from investment banking in which case they might say something like “you’ve done a lot of internships in private equity / VC, do you really want to be an investment banker ?”

Thank you for all your articles that I read daily and which I imagine are really time consuming. You bring a lot of value. On the other side of the Atlantic, really, thank you.

Thanks. I think it’s fine to complete internships in those areas, but you should also do an IB internship at a boutique or smaller firm as well so it doesn’t look like you want to leave right after joining a large bank. There are some tips on why VC internships are often more useful/better than PE internships here: https://mergersandinquisitions.com/venture-capital-to-investment-banking/