Join 307,012+ Monthly Readers

Join 307,012+ Monthly Readers

Free Banker BlueprintPrivate Equity Regions

Real Case Studies About Private Equity Recruitment, Careers and Lifestyles Around The World

Private Equity Worldwide

According to Statista, the USA, China and the UK are the clear leaders in Private Equity activity worldwide, with the USA being the 800 pound gorilla in the room.

However, private equity is a global and diverse industry. Rather than simply publish tables of dry statistics, we’ve assembled real-life case studies on what it’s actually like to work in private equity in different regions of the world.

North America

Because the USA is the dominant country in private equity, most “general” articles on private equity recruitment, interviews, careers and salaries will tend to relate closely to the US market.

Within the USA, private equity activity is concentrated in New York City, although there are at least 10 substantial centers for PE activity Stateside:

If you don’t mind traveling North of the border, here’s a reader case study about moving from IB to Private Equity in Canada.

Europe

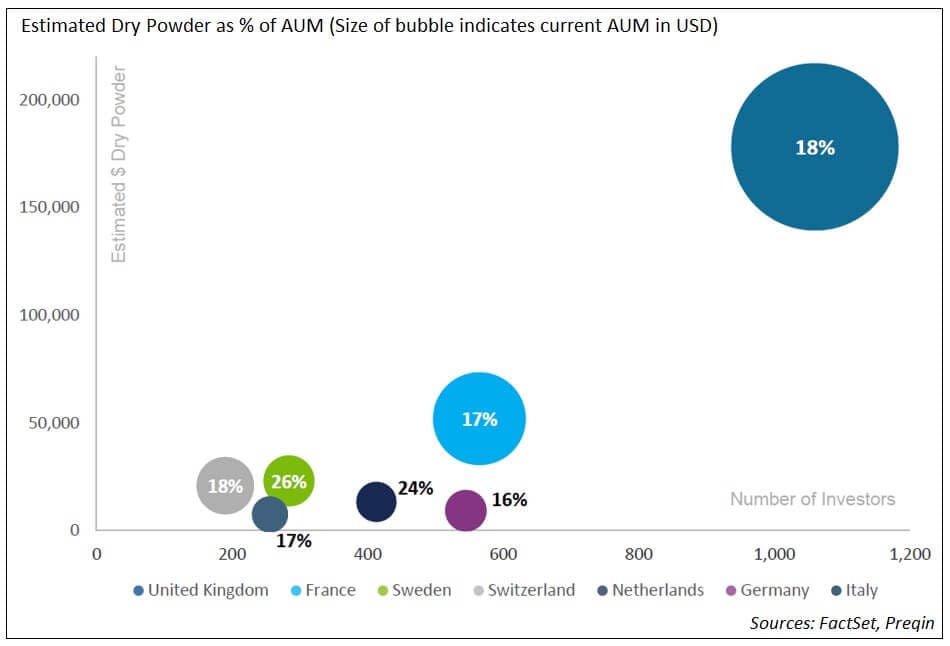

Although Europe features a diverse range of PE firms across countries, the UK is the dominant player, holding an estimated 52% of Europe’s total Assets Under Management (AUM).

According to recent data, UK firms also hold the lion’s share of dry powder available for transactions as of late 2019:

Many of our readers have experienced career success in Europe. Here are some of our most popular PE career case studies:

- [Case Study] What to Expect in Real Estate Private Equity in London When You Join Right Out of Undergrad

- [Case Study] Private Equity in France: The Best Way to Have Your Wine and Drink It, Too?

- [Case Study] Private Equity in Portugal: The Best Way to Break into Finance as a Consultant?

- [Case Study] How to Get Into Private Equity in Russia, and What to Do Next

- [Case Study] Private Equity in Central and Eastern Europe: How to Survive the Jungle

Asia and the Middle East

The Asian Private Equity sector is responsible for approximately 21% of global PE deal volume. By 2011, China accounted for 45% of Asia’s total private equity activity. However, with other countries in the region developing strongly, there is speculation that China’s market share will fall over time.

Some of the Asia-centric reader case studies on our books include:

- [Case Study] Investment Banking and Private Equity in Mainland China: Land of the Surefire 100% IRR?

- [Case Study] How to Break Into Investment Banking and Private Equity in Singapore

- [Case Study] Private Equity in India: The Most Exciting Emerging Market to Invest In?

- [Case Study] Private Equity in the Middle East: The Hottest Market in the World, or a Mirage in the Desert?

South and Central America

Compared with its northern neighbour, PE deal flow in South and Central America is relatively tiny. However some markets – particularly Brazil and Mexico — are showing strong growth and increased deal activity. This may be a region to watch in future.

Frontier Markets

While the USA, Europe, and Asia account for the vast majority of deal activity and capital invested worldwide, private equity is a global field with activity happening in the most unlikely places.

Our readers are reporting career success from all corners of the globe. Firms such as Leopard Capital are making investments in countries as diverse as Bhutan, Bangladesh and Haiti.

And it turns out intrepid M&I readers have even enjoyed PE career success in the Caucasus region of Europe/Asia: the frontier of frontier markets.

Private Equity Courses

Private equity has become a highly competitive and sought-after field.

Private equity firms want people who are technically proficient and who demonstrate strong “fit” because firms and teams are far smaller than those in investment banking.

Banks might have tens of thousands of employees to perform grunt work, but private equity firms have no such armies; they want to hire small teams of the top professionals who can add value from day one.

That’s why many aspiring private equity professionals invest in specialized courses and training to help them get noticed, get hired, and get promoted.

Some of the courses offered by Mergers & Inquisitions and Breaking Into Wall Street that apply to private equity include:

- Investment Banking Interview Guide – Includes a 120-page guide to LBO modeling and 4 practice LBO case studies/modeling tests

- BIWS Premium – This course includes more in-depth LBO case studies and coverage of foundational financial modeling skills

- Advanced Financial Modeling – This features our most advanced LBO model (stub periods, dividend recap, OID, working capital adjustments, etc.) and an open-ended, “take home” private equity case study

- Venture Capital & Growth Equity Modeling – This one is highly relevant for roles investing in earlier-stage companies, where knowledge of cap tables and granular financial models is essential

Completing these courses will help you win interviews and job offers for roles that pay $150K+ and position you for careers in private equity.